All Categories

Featured

Table of Contents

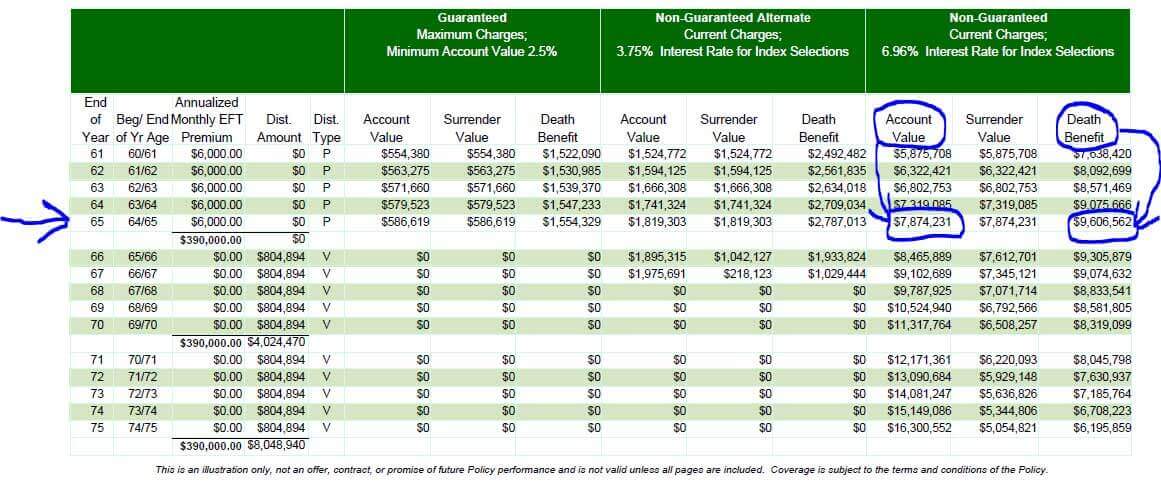

One of the critical aspects of any type of insurance coverage plan is its expense. IUL policies typically come with various charges and fees that can influence their overall value.

But don't just take into consideration the costs. Pay certain interest to the policy's functions which will be very important relying on just how you wish to utilize the policy. Speak with an independent life insurance policy representative that can assist you pick the most effective indexed global life policy for your requirements. Full the life insurance coverage application completely.

Evaluation the plan thoroughly. Now that we've covered the advantages of IUL, it's important to comprehend exactly how it contrasts to various other life insurance coverage policies offered in the market.

By comprehending the resemblances and differences in between these policies, you can make an extra enlightened decision regarding which kind of life insurance is ideal suited for your demands and economic goals. We'll start by contrasting index global life with term life insurance policy, which is often thought about the most simple and budget-friendly kind of life insurance policy.

How do I get Iul Calculator?

While IUL may provide greater possible returns as a result of its indexed money value growth system, it also features greater costs compared to call life insurance coverage. Both IUL and entire life insurance policy are kinds of long-term life insurance policy policies that give death benefit defense and money worth growth possibilities (IUL financial security). Nonetheless, there are some key differences between these two sorts of policies that are essential to consider when determining which one is best for you.

When considering IUL vs. all other kinds of life insurance, it's critical to evaluate the advantages and disadvantages of each plan kind and speak with a skilled life insurance policy agent or financial consultant to establish the most effective choice for your unique needs and financial goals. While IUL provides numerous benefits, it's also vital to be aware of the risks and factors to consider linked with this kind of life insurance plan.

Let's delve deeper right into each of these risks. Among the primary issues when taking into consideration an IUL policy is the numerous expenses and fees linked with the plan. These can consist of the expense of insurance, policy costs, abandonment fees and any kind of extra cyclist prices incurred if you add fringe benefits to the plan.

Some may provide a lot more affordable rates on insurance coverage. Inspect the financial investment options available. You want an IUL policy with a range of index fund choices to satisfy your requirements. Make certain the life insurer aligns with your personal financial objectives, demands, and risk tolerance. An IUL plan ought to fit your certain scenario.

What happens if I don’t have Indexed Universal Life Growth Strategy?

Indexed global life insurance policy can provide a number of advantages for policyholders, including versatile premium payments and the possible to make greater returns. The returns are limited by caps on gains, and there are no warranties on the market performance. All in all, IUL plans provide a number of prospective advantages, but it is vital to understand their threats.

Life is not worth it for lots of people. It has the possibility for big investment gains but can be unpredictable and pricey compared to traditional investing. Furthermore, returns on IUL are generally reduced with substantial fees and no guarantees - Indexed Universal Life investment. Overall, it depends on your needs and goals (Indexed Universal Life cash value). For those looking for predictable long-term cost savings and assured fatality benefits, entire life might be the much better choice.

How do I apply for Iul Tax Benefits?

The advantages of an Indexed Universal Life (IUL) plan include potential greater returns, no downside danger from market movements, defense, adaptable settlements, no age requirement, tax-free death advantage, and lending schedule. An IUL plan is long-term and provides cash value growth through an equity index account. Universal life insurance coverage started in 1979 in the United States of America.

By the end of 1983, all significant American life insurance firms supplied universal life insurance coverage. In 1997, the life insurance firm, Transamerica, presented indexed global life insurance policy which offered insurance policy holders the capacity to connect policy development with global stock exchange returns. Today, global life, or UL as it is also recognized is available in a range of various types and is a huge part of the life insurance market.

The information given in this short article is for educational and informational purposes only and must not be taken as monetary or financial investment recommendations. While the writer has competence in the subject, viewers are recommended to speak with a qualified economic consultant before making any kind of investment decisions or acquiring any kind of life insurance policy products.

How can Long-term Iul Benefits protect my family?

You might not have believed a lot concerning just how you want to invest your retirement years, though you most likely recognize that you do not desire to run out of cash and you 'd like to keep your current way of living. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings". Long-term IUL benefits.] < map wp-tag-video: Text appears beside the organization male talking with the cam that checks out "business pension plan", "social protection" and "financial savings"./ wp-end-tag > In the past, individuals relied on 3 main resources of revenue in their retirement: a business pension, Social Protection and whatever they would certainly managed to conserve

Fewer companies are using typical pension plan strategies. Also if benefits haven't been reduced by the time you retire, Social Protection alone was never ever intended to be enough to pay for the way of living you want and are worthy of.

Before committing to indexed universal life insurance policy, below are some pros and cons to take into consideration. If you select a good indexed universal life insurance policy strategy, you may see your cash value expand in worth. This is practical because you may be able to accessibility this money prior to the strategy ends.

How does Iul Accumulation work?

Since indexed global life insurance policy needs a particular degree of risk, insurance coverage business have a tendency to keep 6. This type of strategy also offers.

If the chosen index does not execute well, your cash money worth's development will be impacted. Generally, the insurance policy firm has a vested rate of interest in performing far better than the index11. There is typically an assured minimum passion rate, so your plan's development will not drop below a specific percentage12. These are all variables to be thought about when choosing the very best sort of life insurance policy for you.

However, because this kind of policy is much more complex and has a financial investment part, it can commonly include greater costs than various other plans like entire life or term life insurance - IUL protection plan. If you don't believe indexed global life insurance coverage is appropriate for you, below are some alternatives to consider: Term life insurance policy is a short-term plan that generally supplies protection for 10 to 30 years

Latest Posts

Meaning Of Universal Life Insurance

Fixed Universal Life Insurance

Top Iul Companies